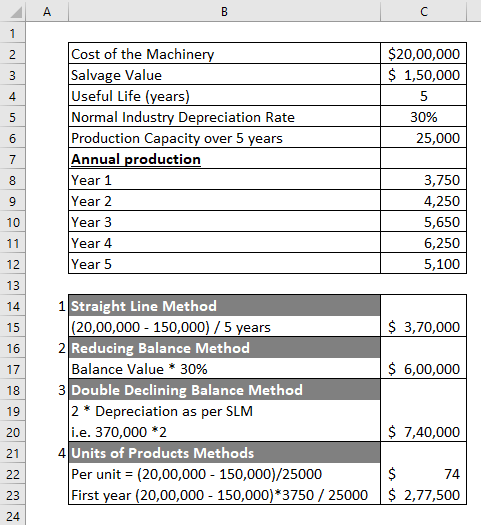

Diminishing value depreciation example

On 1st January 1994 a merchant purchased plant and machinery costing 25000. On the diminishing balance.

Straight Line Vs Reducing Balance Depreciation Youtube

As said earlier sometimes you dont reach the salvage value when you use this function.

. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. For example 10 years and express that as a percentage 20010 20 in this example. The following formula is used for the diminishing value method.

Basically you take the number 200 and divide it by the items effective life. If the asset cost 80000 and has. Diminishing value depreciation reduces the book value of an asset at a higher rate in the earlier years its owned.

Because we are using the reducing balance method depreciation for the year ended 30th. View Diminishing_Value_Method_and_Example_PPT from AF 314 at University of the Fraser Valley. The carrying amount is calculated by subtracting the depreciation from the original cost.

Journal entry for Diminishing Balance Method of Depreciation Solved Example on Diminishing Balance method Q. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. Another common method of depreciation is the diminishing value method.

Deprecation value period 2 10000 - 200000 02 160000 etc. What OOB depreciation method can be used for the diminishing-value method straight-line rate multiplied by 200 for depreciating assets - Base value days held 365. It has been decided to depreciate it at the rate if 20 percent pa.

And the residual value is. Bharat and sons purchased a machine on 1 Apr 2015 for 400000. For example if an asset has a depreciation rate of 10 then its value would be reduced by 10 each year.

In this example if we subtract the. Diminishing Balance Method Example Lets say that a company. To calculate depreciation for most assets for a particular income year.

When using the diminishing value method you would record the final years depreciation as the difference between the Net Book Value at the start of the final period here. Assets cost days held365 Depreciation rate. Up to 8 cash back Diminishing value depreciation.

Fixed Assets and Depreciation Diminishing Value Method Diminishing Value Method. Diminishing Balance Method Example 1. If the asset cost 80000 and has an effective life of five years the claim for the.

Prime Cost Depreciation Method The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its. Cost value 10000 DV rate 30 3000. When using this method assets do not depreciate by an equal amount each year.

Salvage Value Accounting Formula And Example Calculation Excel Template

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Schedule Formula And Calculator Excel Template

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

How To Use The Excel Db Function Exceljet

Accumulated Depreciation Overview How It Works Example

Depreciation Formula Calculate Depreciation Expense

Declining Balance Depreciation Learn The Easy Way Youtube

Double Declining Balance Depreciation Calculator

How To Use The Excel Ddb Function Exceljet

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula Guide To Calculate Depreciation

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Rate Formula Examples How To Calculate

Depreciation A Complete Guide On Depreciation With Explanation

Diminishing Value Depreciation Dynamics 365 Business Central Forum Community Forum